Fitch Ratings: Russian Container Port Market Recovering, But Growth Slows.

Транспорт и логистика » Деятельность портов

Транспорт и логистика » Железнодорожный транспорт

Транспорт и логистика » Логистика

Транспорт и логистика » Железнодорожный транспорт

Транспорт и логистика » Логистика

19.02.2019 в 15:57 | INFOLine, ИА (по материалам компании) | Advis.ru

Latest container throughput results of Fitch-rated Russian ports indicate that the recovery of the Russian container port market continues, although future growth is likely to be muted, Fitch Ratings says. The market remains predominately import-driven.

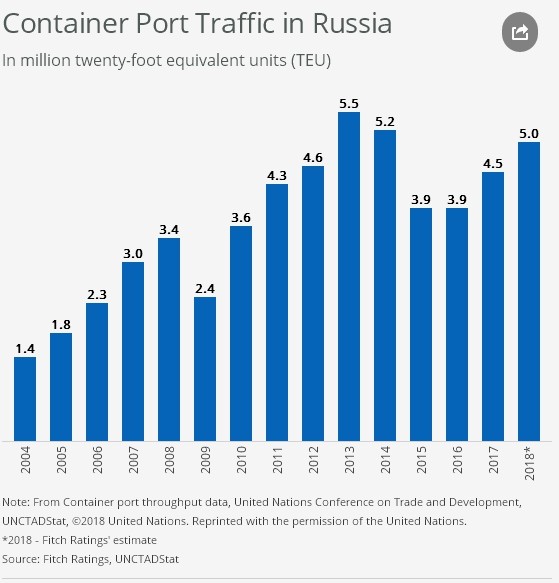

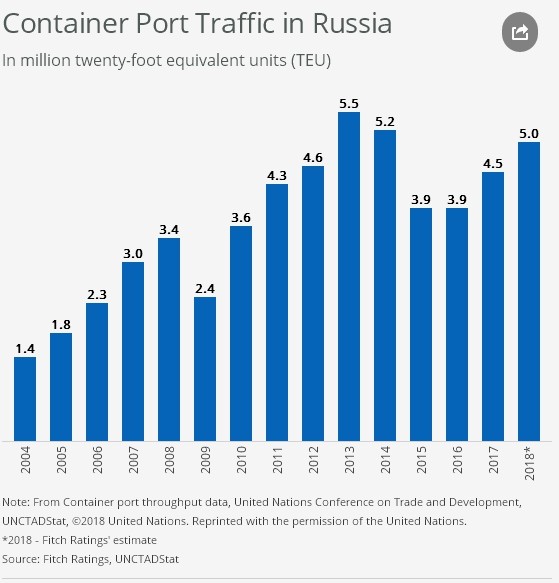

Last year, turnover at DeloPorts NUTEP container terminal rose 10%, while Global Ports increased its container throughput by almost 16% in the first half of 2018. These reports confirm our estimates for 2018 full-year throughput growth in Russia of about 10% to 5 million twenty-foot equivalent units (TEU). A recovery in imports, due to stronger consumer demand, was the primary growth driver. Increased export containerisation and growth in export volumes due to previous rouble devaluation further supported market recovery.

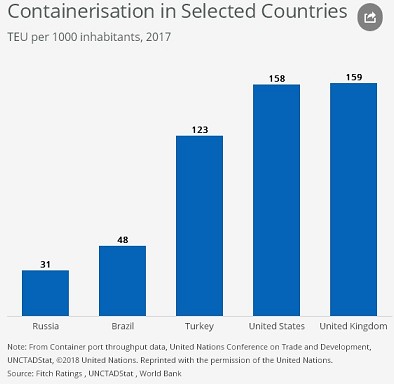

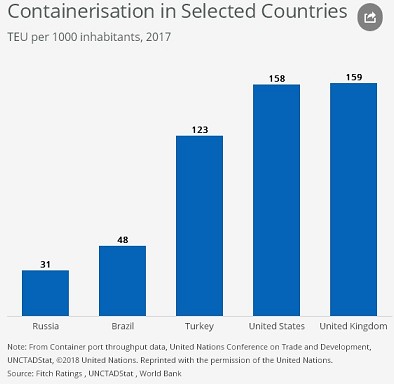

The Russian market remains "under-containerised" compared with many other countries, due partly to the later start of containerisation in the country, and this suggests further growth potential. Containerisation, measured as throughput per thousand inhabitants, is 31 TEU in Russia versus 123 TEU in Turkey and 158-159 TEU in the developed markets of the US and the UK.

Volumes are still below the 2013 peak, however, and we expect growth rates to be lower because it would be difficult to maintain the accelerated pace of 2017-2018. A range of factors, including macroeconomic development, integration of Russia into the world economy, and a potential escalation of sanctions, could affect future container volume growth.

We expect that Russian GDP growth will strengthen to 1.9% in 2020 from 1.5% in 2017 (and forecast 1.8% in 2018 and 1.5% in 2019) as our base case, supported by stronger domestic demand, which could benefit container volumes.

We consider the Russian container market to be more volatile than those in many other countries. In the past decade there have been two periods when volumes dropped substantially, based on UNCTADStat data: in 2009 by around 28% during the global financial crisis, and in 2015 by around 25% due to a deterioration of the macroeconomic environment and sharp rouble depreciation. These were followed by periods of steady recovery.

Many port operators (stevedores) in Russia are upgrading their handling equipment and infrastructure due to the ongoing market recovery, thus improving their operational efficiency and productivity, increasing the quality of customer service, reducing unit costs and consequently increasing their competitiveness. For example, DeloPorts has been developing a new deep-water container terminal (known as project Berth No. 38) at its NUTEP facility in the Black Sea port of Novorossiysk. The facility, due for completion in 2019, will be able to receive and service larger vessels of up to 10,000 TEU. This will help avoid the need to stop and unload shipments to smaller feeder vessels in hub ports like Istanbul in Turkey or Piraeus in Greece, thereby providing costs savings for shipping companies.

Last year, turnover at DeloPorts NUTEP container terminal rose 10%, while Global Ports increased its container throughput by almost 16% in the first half of 2018. These reports confirm our estimates for 2018 full-year throughput growth in Russia of about 10% to 5 million twenty-foot equivalent units (TEU). A recovery in imports, due to stronger consumer demand, was the primary growth driver. Increased export containerisation and growth in export volumes due to previous rouble devaluation further supported market recovery.

The Russian market remains "under-containerised" compared with many other countries, due partly to the later start of containerisation in the country, and this suggests further growth potential. Containerisation, measured as throughput per thousand inhabitants, is 31 TEU in Russia versus 123 TEU in Turkey and 158-159 TEU in the developed markets of the US and the UK.

Volumes are still below the 2013 peak, however, and we expect growth rates to be lower because it would be difficult to maintain the accelerated pace of 2017-2018. A range of factors, including macroeconomic development, integration of Russia into the world economy, and a potential escalation of sanctions, could affect future container volume growth.

We expect that Russian GDP growth will strengthen to 1.9% in 2020 from 1.5% in 2017 (and forecast 1.8% in 2018 and 1.5% in 2019) as our base case, supported by stronger domestic demand, which could benefit container volumes.

We consider the Russian container market to be more volatile than those in many other countries. In the past decade there have been two periods when volumes dropped substantially, based on UNCTADStat data: in 2009 by around 28% during the global financial crisis, and in 2015 by around 25% due to a deterioration of the macroeconomic environment and sharp rouble depreciation. These were followed by periods of steady recovery.

Many port operators (stevedores) in Russia are upgrading their handling equipment and infrastructure due to the ongoing market recovery, thus improving their operational efficiency and productivity, increasing the quality of customer service, reducing unit costs and consequently increasing their competitiveness. For example, DeloPorts has been developing a new deep-water container terminal (known as project Berth No. 38) at its NUTEP facility in the Black Sea port of Novorossiysk. The facility, due for completion in 2019, will be able to receive and service larger vessels of up to 10,000 TEU. This will help avoid the need to stop and unload shipments to smaller feeder vessels in hub ports like Istanbul in Turkey or Piraeus in Greece, thereby providing costs savings for shipping companies.

Введите e-mail получателя:

Укажите Ваш e-mail:

Получить информацию:

Получить информацию: